Culture Republic is undertaking an ambitious piece of research with arts and cultural organisations across Scotland focused on audience data, ticketing and customer relationship management (CRM) systems, and digital technology.

As a context-setting first step, we carried out desk research that looked at public facing operational functions carried out by arts organisations – things like whether or not an arts organisations’ website is optimised for mobile browsing or if they offer online ticket sales.

This effort was devised to operate as a kind of ‘dipstick test’ that would give us an early indication of how effectively Scottish arts organisations are operating online. Culture Republic looked at five key areas: organisations’ website, online ticket sales, organisations’ social media presence, the kinds of data that organisations capture and other sources of online income generation.

Broadly, through our work over the past decade with arts organisations we have seen a growth in areas of online business operations. This growth, along with the increasing cost of systems, brings with it a growing need for organisations to be vigilant about ROI of their business systems. A key and related concern here is around skills and capabilities of the staff members using these systems. Without the right skills the investment is not being maximised. We have seen cases of organisations with high powered systems that aren’t using them to their full capacity as well as cases of organisations that are forced to work inefficiently and waste effort due to inappropriate or inadequate business systems and both will reduce an organisation’s ROI.

The research exercise was devised to give us an insight into the kinds of digital systems that arts organisations are implementing as well as the kinds of training that staff might need to use these systems. For Culture Republic this gives a strategic indication of where organisations might need support and where we might help organisations to work together and learn from each other. Recent (and ongoing) changes in technology and the increased levels of consumer adoption of these technologies has created an increased potential for income generation for arts organisations through their online channels. But it is not clear that these increased opportunities are being exploited.

THE SAMPLE

Culture Republic researchers visited over 170 Scottish arts organisations’ websites. The sample includes all of the Creative Scotland Regularly Funded organisations, all of Culture Republic’s Partner and client organisations, as well as arts organisations from all across Scotland and a range of different art forms. This group was not selected to be representative of the full diversity of Scotland’s arts organisations – especially as it includes a much higher proportion of large organisations than is present in the Scottish arts sector as a whole. We selected this group because it is a good bellwether for wider trends and it in many ways forms the backbone of the wider network of Scottish arts organisations.*

WHAT DID WE LEARN?

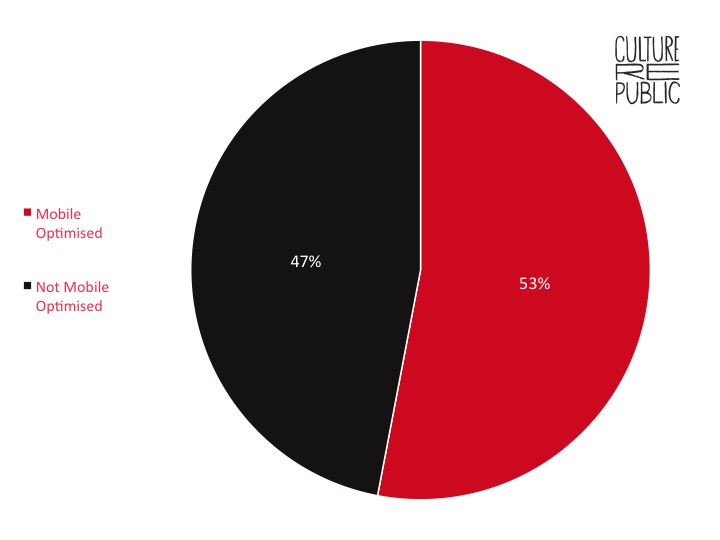

Web

All of the 173 organisations in our sample have their own website. The functionality of these sites varies, however. We looked in particular at mobile optimisation. To find this, each organisations’ home page was tested. This test found that almost half of the organisations’ websites – 47% – were not optimised for mobile browsing. Even if the homepage is optimised, it may be the case that other pages on website are not. At a recent Culture Republic event – The Future of CRM and Ticketing – the issue was raised that even when the rest of a website is optimised, online booking pages are often not mobile friendly.

47% of arts organisations’ websites are not mobile optimised.

This is a significant weakness for arts organisations. The radical growth in consumers’ transition from desktop to mobile browsing means that the look and feel of non-optimised sites will be compromised. Moreover, search rankings are downgraded in Google’s updated algorithm if a site is not optimised for mobile browsing.

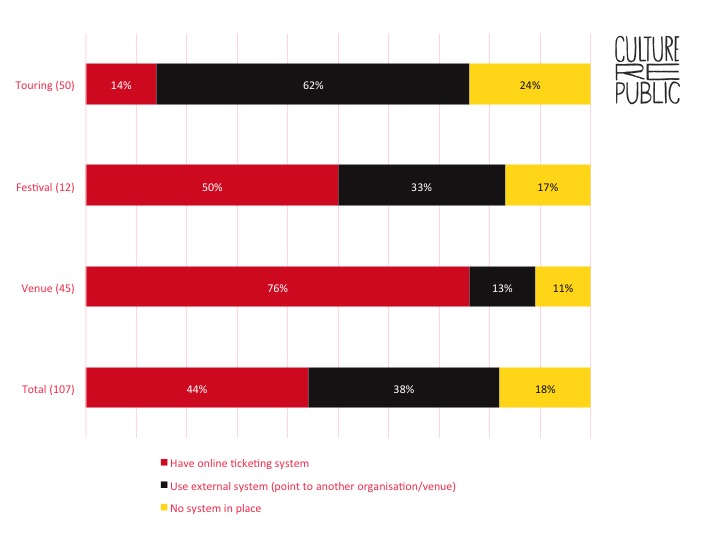

Ticket sales

In the next phase of the research, we looked at how many arts organisations offer online ticket sales. As this is not something that is relevant to all arts organisations – art galleries for instance may have a limited need of an online ticketing system – the sample for this section was limited to the 107 organisations for which it was relevant. This includes venues (performing and visual arts that hold ticketed events), touring companies and festivals. This phase of the research does not look into which online ticket sale system organisations are using. This question is being asked in the survey phase of the research, currently underway.

Most venues (89%) offer online ticketing.

As is clear from the table above, most venues (89%) offer some form of online ticket sales, the majority of them, 76%, through their own in house system. Although, there are still 11% of venues that do not offer any online sales. Touring companies are least likely to sell their own tickets – with 62% sending audiences on to an external ticketing site (mostly the venue) or Eventbrite and nearly a quarter with no online sales option at all.

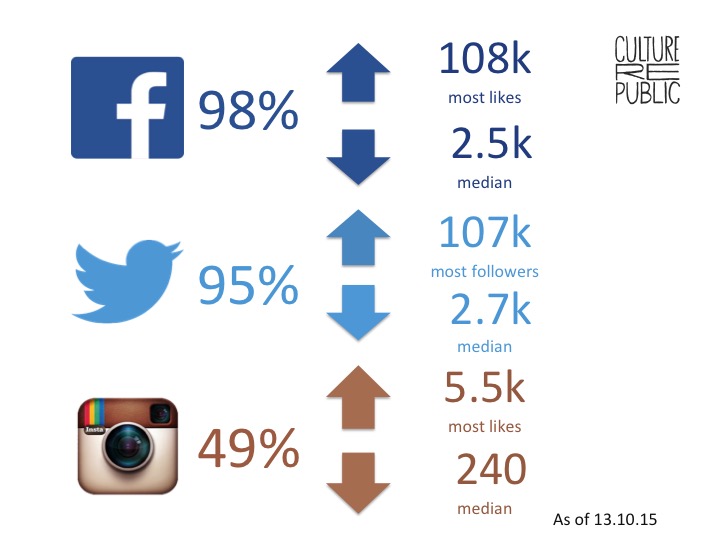

Social Media Presence

The data table below shows that the vast majority of the organisations in our sample were active on the two main social media channels – Facebook (98%) and Twitter (95%). Although on both of the main channels there were significant outliers with more than one hundred thousand likes or followers, the average (median) size of a Facebook community is just over 2,500 and for Twitter it’s over 2,700. Interestingly, with Twitter we see no link between the number of Tweets and the number of followers.

Although Facebook and Twitter are currently the dominant social media platforms – with Facebook reaching almost half (49%) of the UK population and Twitter nearly a fifth (19%) according to Social Media London – Instagram is nipping at their heels with exceptional growth in the UK market. In our sample almost half (49%) of the arts organisations have started an Instagram profile and they are building audiences for their content. Importantly, the demographics for Instagram audiences skew younger so the audience reached on this channel is likely to be different than the one reached by Facebook and Twitter. As with Twitter, our research showed no correlation between the number of photos posted and the number of followers.

The most popular social media channels are Facebook and Twitter.

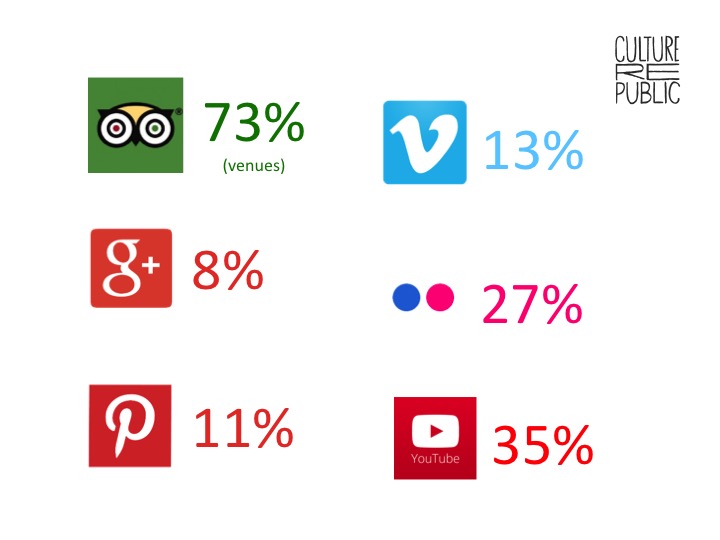

We also looked at other social media channels used by the arts organisations in the sample in addition to the big three above. The next most popular channel is YouTube, used by 35% of our sample, followed by Flickr (27%), Vimeo (13%), Pinterest (11%) and Google + (8%).

Arts organisations are also active on a range of other social media channels.

Finally, we also looked at organisations’ presence on Trip Advisor. Because this channel is not relevant to all organisations we used the same sample as in the Ticket Sales section above. In this group, we found that nearly three quarters (73%) are present on this channel. Trip Advisor is well worth thinking about: according to Business Insider “the site is now so big that its reviews can shift the tourist economies of entire countries” and moreover its power as a marketing tool can have a direct effect on a company’s bottom line.

Data Capture

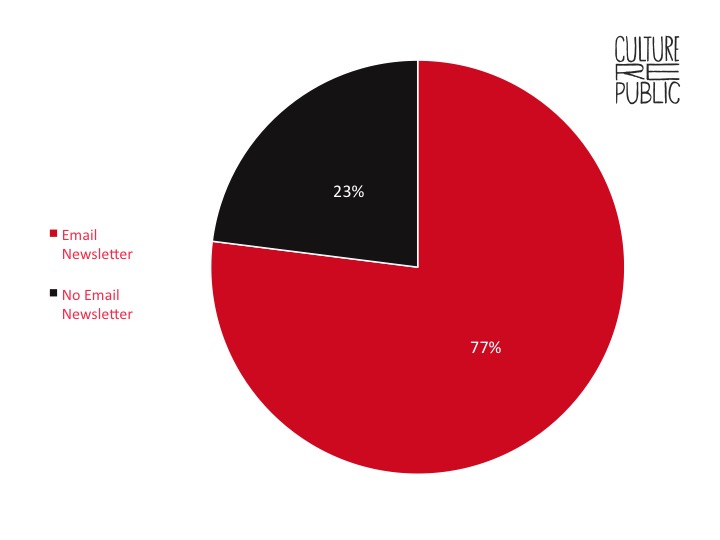

This part of the exercise looked at the different kind of information that is requested when organisations undertake data capture on their websites. The sample for this section covers all 173 organisations. What’s most interesting about these findings is the wide range and relative lack of consistency we see in terms of data capture across organisations. Organisations in the sample were most likely to ask for email address information online. Over three quarters (77%) of them have an email newsletter sign up on their website.

77% of the organisations have an email newsletter signup.

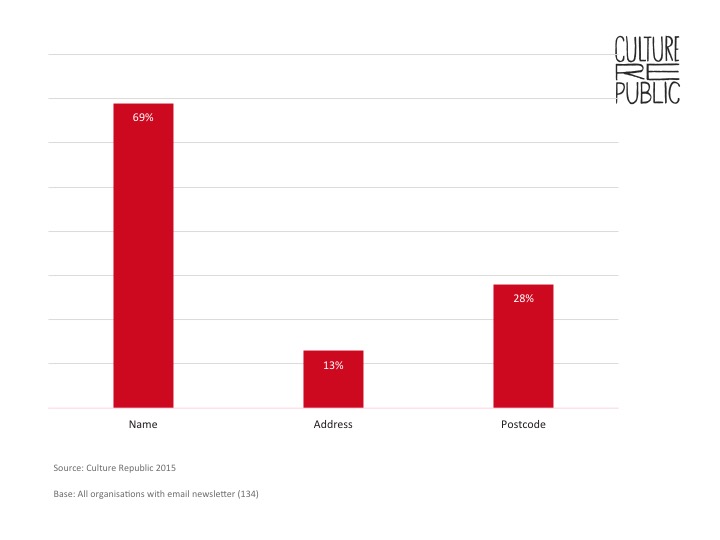

The other most common data requested in online forms is, as shown by the table below, name (69%), postcode (28%) and other address information (13%). Some of the other pieces of data that we found were being gathered include: interests (usually in regards to selecting email newsletter contents), age, gender, phone number, how users heard about the organisation, profession, region or other general comments.

Only 28% of the organisations samples are collecting postcode data online.

These findings raise a few red flags. At Culture Republic we deal with data on a day-to-day basis and would advise organisations not to gather data that they do not actually use. There will be cases where there are good reasons for gathering some of this information we would advise any organisation against collecting much of this information ‘just in case’.

The relatively low number of organisations gathering postcode data (less than a third) is also concerning. With this one small piece of information arts organisations could access a large amount of useful market and demographic information, and the opportunity to do so is one that should not be missed. Of course, it may be that organisations are gathering this information at a later date, and such an effort would not show up in this research. It may also be that we are seeing the results of a wider trend away from capturing address and postcode data and toward email capture because organisations are looking to online marketing for more targeted and cost effective engagement. As arts organisations work to reduce the costs of their printing and postage costs, we know from anecdotal evidence that many are moving away from print brochures or are printing fewer for mainly non postal distribution, favouring brochure stands or door drops. Despite this move away from posting print brochures, Culture Republic does still encourage arts organisations to prioritise gathering postcode data on account of the intelligence it can reveal.

Income Generation

The final section looks at some of the range of tools for income generation used by all 173 Scottish arts organisations in the sample in addition to ticket sales. We looked at these because – in these post-recession years of dwindling public funding and an increasing push toward earned income – making money is on arts organisations’ minds.

This data primarily relates to online fundraising, membership schemes and online shops for merchandise. By fundraising we mean inviting donations online (via a button or any other call to action) but we do not include corporate sponsorship. By membership we mean any sort of scheme where a customer can pay to be a member and receive benefits – discounted tickets, discounted merchandise, etc. Membership should not be confused with a general ‘account’ that users can set up on an organisation website.

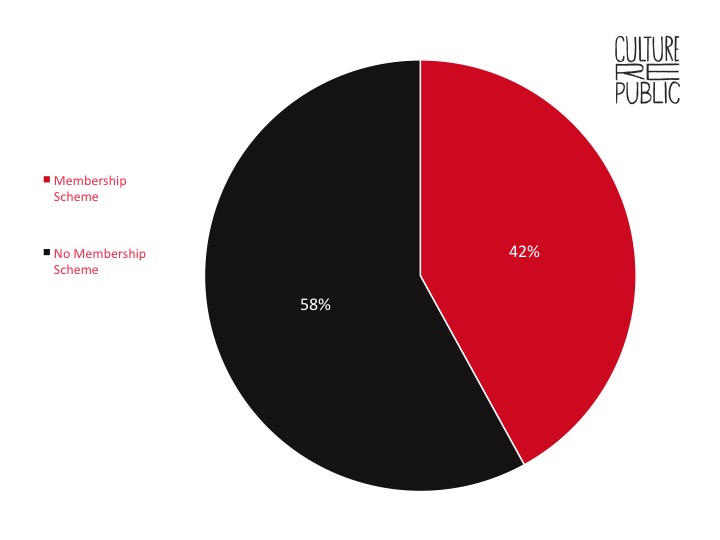

What we found is that over half (58%) of the organisations in the sample offer an online membership option. Though, this does not necessarily mean they do not offer a membership to loyal audiences.

42% of the organisations sampled offer a membership scheme online.

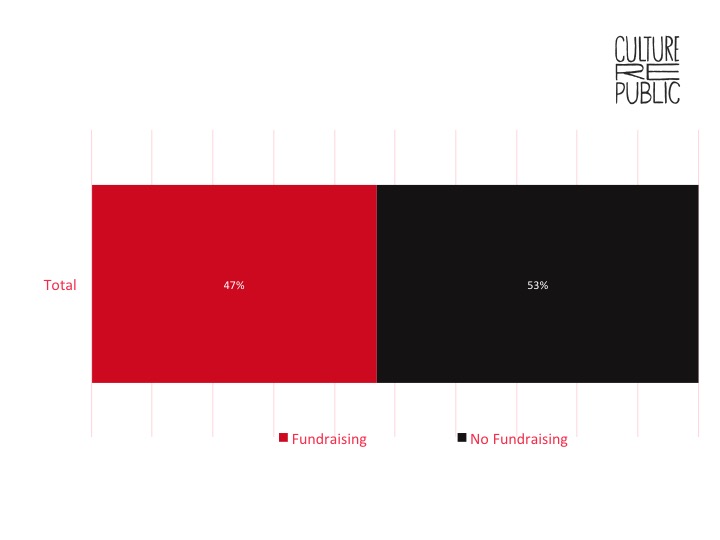

The slightly more popular way for organisations aiming to earn additional income online is through online charity fundraising. Whilst 53% of organisations are not doing any form of fundraising online, they may do fundraising in-venue or at events.

47% of the organisations sampled are doing some kind of online fundraising.

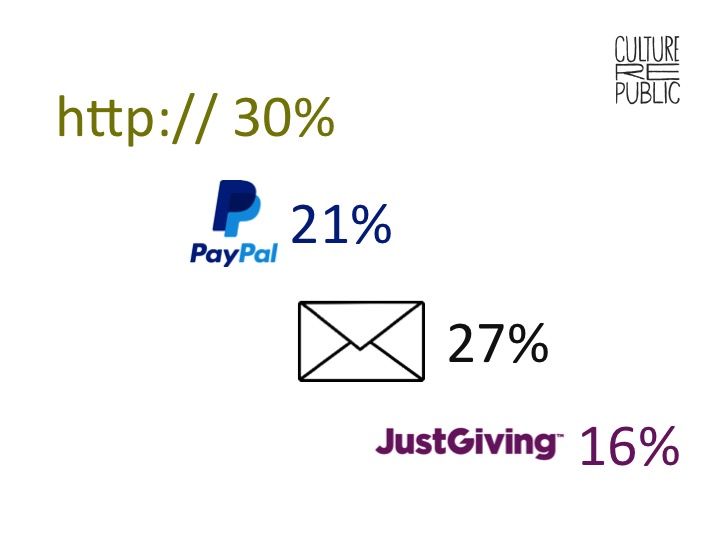

Of those that are fundraising online (base = 81) we looked in greater depth at the different ways that organisations are inviting donations. Nearly a third (30%) feature a ‘donate now’ button on the site, which simply adds money to an online shopping basket. Over a quarter (27% indicated by the envelope icon) use a direct method that includes paper forms to print out and post in or a link to a phone number to call to make a donation (not text giving via mobile). These invitations also solicited donations via cheque, direct debit or bank transfer. Other forms of online giving included services like: Pay Pal, Just Giving, Local Giving, The Big Give, BT My Donate, Virgin Money or Easy Fundraising. Additionally, in some cases users were also invited to sponsor a seat, add a suggested donation on during the ticket purchase process or to make regular Give As You Earn donations. See the figure below for the most popular methods of soliciting donations.

Nearly a third (30%) feature a ‘donate now’ button on the site.

The range of additional income generating systems gives a useful insight into the range of operational systems in use by arts organisations. These are important to consider and include because their presence speaks to the complexity of organisations’ operations and management and may well have a knock-on effect around overall efficiency.

WHAT’S NEXT FOR OUR RESEARCH

Culture Republic’s wider research project, which surveys arts organisations across Scotland is happening now. If you work in the arts in Scotland we would love for you to take 10 minutes to feed in and share your perspective.

The research will give insight into the types of information routinely collected from audiences and visitors; the range and use of ticketing and CRM systems in operation, and how digital technology is being used in creative processes, marketing, the delivery of cultural experiences, and organisational development.

It is designed to help us help the Scottish cultural sector. The research will show where there are gaps in knowledge and infrastructure for arts and cultural organisations across Scotland, and therefore help us create practical solutions and training programmes where necessary to increase resilience and capacity.

*The organisations that feed into the research survey will not necessarily be the same organisations that we looked at in the desk research phase. Although most of the organisations in the sample were invited to participate in the survey there has been a small amount of movement in the overall sample between the desk research and the survey phase.

Main image credit: Research Data Management by Janneke Staaks (CC BY-NC 2.0)